Optimize Spending & Increase Income by 10%: A Financial Guide

Optimizing spending and increasing income by 10% involves strategic budgeting, debt management, exploring additional income streams, and making informed investment decisions to achieve financial goals.

Unlock financial stability and growth by learning how to optimize spending and increase income by 10%, paving the way for a secure future.

Understanding Your Current Financial Situation

Before embarking on a journey to optimize spending and increase income by 10%, it’s crucial to understand your current financial landscape. This involves assessing both your income and expenses to identify areas for improvement.

Calculating Your Net Income

Net income is the amount of money you take home after taxes and other deductions. Knowing this figure is essential for budgeting and financial planning.

Tracking Your Expenses

Tracking expenses can reveal where your money is going. Use budgeting apps, spreadsheets, or good old-fashioned notebooks to monitor your spending habits.

- Categorize your expenses: Differentiate between fixed (rent, mortgage) and variable (groceries, entertainment) costs.

- Identify spending leaks: Uncover areas where you can potentially cut back.

- Use budgeting tools: Leverage apps or software to automate expense tracking.

Understanding your current financial situation provides a solid foundation for making informed decisions and creating a realistic plan to optimize spending and increase income by 10%.

Creating a Realistic Budget

A well-structured budget is the cornerstone of optimizing spending and increase income by 10%. It helps you allocate your resources effectively and stay on track with your financial goals.

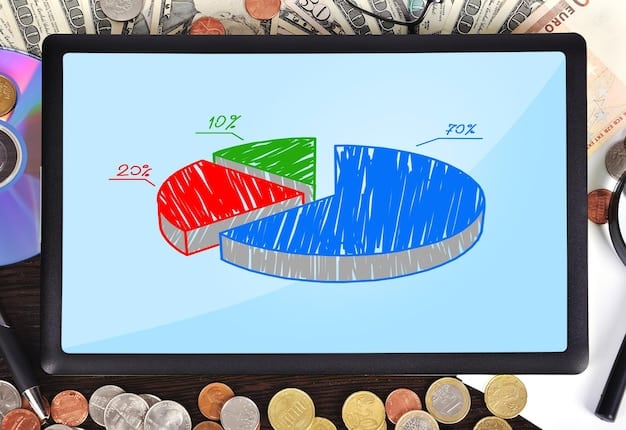

The 50/30/20 Rule

This popular budgeting method allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Zero-Based Budgeting

Zero-based budgeting requires you to allocate every dollar of your income to a specific purpose, ensuring that no money is left unaccounted for.

- Set clear financial goals: Define what you want to achieve with your budget, whether it’s saving for a down payment, paying off debt, or investing for retirement.

- Track your progress: Regularly review your budget and make adjustments as needed to stay on track.

- Be realistic: Create a budget that reflects your actual income and expenses, and be prepared to make changes as your circumstances evolve.

Creating a realistic budget empowers you to take control of your finances and work towards optimizing spending and increase income by 10% effectively.

Strategies to Reduce Spending

One of the most direct ways to optimize spending and increase income by 10% is through reducing your expenditures. This involves identifying areas where you can cut back and implementing strategies to save money.

Look for subscription services you don’t frequently use, and consider cancelling them.

Cutting Unnecessary Expenses

Identify non-essential expenses that can be reduced or eliminated, such as eating out less often or finding cheaper alternatives for entertainment.

Negotiating Bills

Contact your service providers to negotiate lower rates on your bills, such as internet, cable, and insurance. Many companies are willing to offer discounts to retain customers.

- Shop around for better deals: Compare prices and switch providers when you find a better offer.

- Use coupons and discounts: Take advantage of promotions and discounts to save money on everyday purchases.

- Consider alternatives: Explore free or low-cost alternatives for entertainment and other expenses.

Reducing spending is a critical step in optimizing spending and increase income by 10%. By implementing these strategies, you can free up more of your income for saving and investing.

Exploring Additional Income Streams

While reducing spending is important, increasing your income can also significantly contribute to optimizing spending and increase income by 10%. Exploring additional income streams can boost your overall financial standing.

Freelancing and Gig Economy

Offer your skills and services on freelance platforms to earn extra money in your spare time. This can include writing, graphic design, web development, and more.

Investing

Consider investing in stocks, bonds, or real estate to generate passive income over time. Understand the risks involved and diversify your investments to mitigate losses.

- Start a side hustle: Turn a hobby or passion into a profitable side business.

- Rent out assets: Consider renting out a spare room, parking space, or other assets to generate income.

- Sell unused items: Declutter your home and sell unwanted items online or at a local market.

Exploring additional income streams provides opportunities to optimize spending and increase income by 10%. By diversifying your income sources, you can create a more resilient financial position.

Debt Management Strategies

Debt can be a significant obstacle to optimizing spending and increase income by 10%. Effective debt management is essential for achieving financial stability and freeing up resources for saving and investing.

Debt Consolidation

Consolidating your debts into a single loan with a lower interest rate can simplify repayment and reduce overall interest costs.

The Debt Snowball Method

This strategy involves paying off your smallest debts first to gain momentum and motivation.

- Create a debt repayment plan: Prioritize your debts based on interest rates and payment terms.

- Negotiate with creditors: Contact your creditors to negotiate lower interest rates or payment plans.

- Avoid taking on new debt: Refrain from accumulating additional debt while you’re working to pay off existing obligations.

Effective debt management plays a crucial role in optimizing spending and increase income by 10%. By reducing your debt burden, you can allocate more resources to savings and investments.

Setting Financial Goals

Setting clear and achievable financial goals is essential for staying motivated and focused on optimizing spending and increase income by 10%. Having specific goals in mind can drive your financial decisions and actions.

Short-Term Goals

These are goals that you can achieve within a year, such as saving for a vacation or paying off a credit card.

Long-Term Goals

Long-term goals take several years to achieve and may include buying a home, funding your retirement, or starting a business.

- Make your goals SMART: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Visualize your success: Imagine what it will feel like to achieve your financial goals to stay motivated.

- Celebrate small wins: Acknowledge and celebrate your progress along the way to maintain momentum.

By setting clear financial goals, you create a roadmap for optimizing spending and increase income by 10%, making your financial journey more purposeful and rewarding.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting | Create a realistic budget to track income and expenses. |

| 📉 Reduce Spending | Cut unnecessary costs and negotiate lower rates on bills. |

| 🚀 Increase Income | Explore freelance work or invest to generate extra income. |

| 🎯 Financial Goals | Set achievable short and long-term financial objectives. |

Frequently Asked Questions

▼

Use budgeting apps, spreadsheets, or a notebook. Categorize your spending and review it regularly to identify areas where you can cut back. Consistency is key to effective expense tracking.

▼

Consider debt consolidation to lower interest rates or use the debt snowball method to pay off smaller debts first, providing motivation. Always prioritize high-interest debts to save money.

▼

Explore freelancing, start a side hustle based on your skills or hobbies, or invest in stocks or real estate for passive income. Diversifying income can enhance financial stability.

▼

This rule allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It’s a simple way to balance your financial priorities and ensure savings are prioritized.

▼

Setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) provides clarity, motivation, and a roadmap for your financial decisions. It helps you stay focused and track your progress.

Conclusion

Optimizing spending and increase income by 10% requires a combination of strategic budgeting, expense reduction, and income diversification. By understanding your financial situation, setting realistic goals, and implementing effective strategies, you can achieve financial stability and growth.